Osborne & Carney try to stabilise markets … and fail, at first

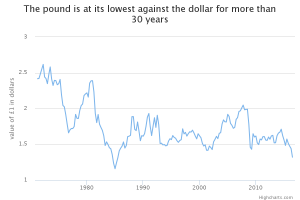

As George Osborne, David Cameron, Boris Johnson, and the Bank of England’s Mark Carney rush to reassure the financial markets – the Pound, the FTSE, and the UK’s sovereign credit rating all dive. Sterling has been battered and remains at a 31-year low, the FTSE 250 has witnessed in as many days two of its top-five one-day losses, and S&P have trashed our credit outlook by two-notches, increasing borrowing for the Government and businesses. A second BoE reassurance on Tuesday 5 July caused the FTSE 250 and Pound to dive further.

Former Governor of the Bank of England, Mervyn King essentially said “Keep Calm, Don’t Panic”:

“Markets move up, markets move down. We don’t yet know where they will find their level…What we need is a bit of calm now, there’s no reason for any of us to panic.”

Was this just a two-day shock? We haven’t seen all out financial Armageddon, but just what are we getting, and for how long?

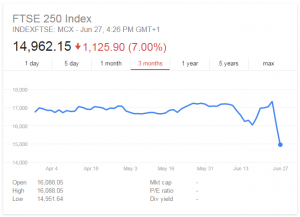

As of Tuesday 28 June morning, adventurous investors were buying into the flatlined market and the FTSE 100 was up 2% and FTSE 250 up 3.3%, although within the hour the gains had fallen back to 2.6-2.8% – still 11% down since the Referendum. At the close it was 3.5% up, restoring a quarter of its Brexit losses. To quote the Financial Times, Markets Live blog:

“It’s still a bloody mess, even if markets have steadied.” FT, 11am Tuesday 28 June

In the first hour of Tuesday’s trading the Pound was up just 1%, barely 1.5c higher after its 18c fall, but by 10.30am had lost half that gain already, only to regain it after lunch and lost most of it by 5pm. There has been no recovery against the € Euro.

Perhaps, this was on hopes of a second referendum, called for by millions including Tory Health Secretary Jeremy Hunt, and Sir Richard Branson, despite being ruled out by the outgoing PM, David Cameron.

By Wednesday 29 June midday, the FTSE 100 had recovered all of its losses, whilst the FTSE 250 remained 10% down.

It could be, too, that the market is recovering on the news that nothing will happen in the short term, that Brexit reality is delayed, and won’t kick-in properly till after Article 50 is actioned and up to 2 years later Exit terms agreed and then years worth, but some counts 5-10 years, of negotiating new trading terms with the EU and some 50 agreements with the rest of the world that were based on our membership of and access to the European Single Market.

Thursday 30 June saw previous day gains restore the FTSE 100 to parity and by the close it was 2% above 23 June’s high. Whilst the more British based companies index, the FTSE 250, remains 7% down despite two more days of gains. It has gained 8.5% or 1300pts up on 14,967 since its low point on Monday. The Pound:Dollar exchange rate added 2%, lost 1% overnight, then made it back by lunch but after Mark Carney said financial easing might be required and Boris Johnson ruled himself out of the Conservative leadership, the Pound lost all the week’s gains, falling another 1.5% and remains 12% down.

In a Radio 4 interview early this week, George Osborne repeated his claim that Brexit “would make Britain poorer” and lead to “an economic downturn”.

Mark Carney had been accused of breaching the Bank of England‘s (BoE) independence by commenting quite forcefully pre-Referendum that Brexit might trigger recession. So, for him to say we are “resilient” now, is a little “flip-flop” but he did say that in the long term growth would be slower and the Bank could only “mitigate” against negative effects rather than resolve them. Mitigation includes the possible injection of £250bn.

Currency Markets

The £ Pound on Monday did not rally against the $ Dollar, instead, it continued its slide to around $1.31, nearly 13% off its 2016 peak to which it had risen on the short term belief that the UK would Remain. Instead, it has settled at its lowest level for 31 years, despite a 1% recovery on Tuesday morning. A week later, and by Wed 6 July Sterling dropped as low as $1.28 and is now hovering at $1.29, a 15% devaluation.

Sterling is predicted to fall further to around $1.15-$1.25, a 20-25% devaluation. This could add 15-20p to a gallon/3-5p a litre to the price of petrol within the month, as oil is priced in Dollars. There could be an 8% rise in food and drink prices imported from Europe since at €1.17 the Pound is 23% off its Euro peak and nearly 9% down since Thursday.

Global Stocks and UK Shares

Some $2.5 trillion was wiped off global markets in hours after the Referendum result – between 100-400 years worth of the nobody-can-agree-on-the-actual-figure of UK contributions to the European Union. Seeing £100bn wiped off leading FTSE companies in 2 days is way more than the £350m a week (less than £10bn/year after rebates) supposed EU savings, i.e., equivalent to more than a decade’s worth of EU contributions. So no new money for the NHS then!

Stock markets in the poor-performing economies of Europe, e.g., Greece, Italy and Spain, tumbled 12-15% on Friday, other world markets fell 3-8%.

Italy announced a €40bn rescue of its banks after they lost a third of their value post-Brexit vote, despite a 5% bounceback they remain over 25% down since Thursday, June 23.

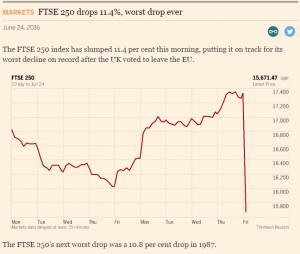

FTSE 250 as UK Financial Indicator

A far better indicator than the FTSE 100, which has ‘only’ seen 2-3% daily falls since Brexit and a 2% recovery on Tuesday, is the FTSE 250. It is made up of more mid-size predominantly British companies with 50-70% UK-based trade – the powerhouse of employment in the UK. Some 75% of Small and Medium Enterprises (SMEs) voted Remain.

The FTSE 250 has lost over 14% since Thursday’s vote, reaching 7% late-afternoon, continuing its near-8% slide last Friday when, at its worst, it dropped 14% in hours – its “worst drop ever”. It’s nearly 20% off its peak due to Brexit uncertainty over the last few months, its worst crash since 1987. During the 2008 crash, over a number of months, it lost nearly half its value leading to lay-offs. recession and austerity.

As to the financial market reaction not being as bad as 2008, that is not yet evident. The FTSE 100 is insulated by its international makeup but the FTSE 250 is more British. Back in October 2008’s crash it suffered a one-day fall of around 6.5% amounting to nearly 40% over 3-4 months. After the Referendum, it’s lost 8% and 7% across 2 days. It’s fourth and fifth biggest one-day falls ever from Sep/Oct 2008 have been eclipsed by Brexit day 1 and day 2, so far. This is the worst FTSE 250 crash since 1987, although Brexit days 3 and 4 are looking brighter, having recovered over a third of the losses, yet it remains 10% down, despite 1.9% gains Wednesday morning. A week later and by Wed 6 July, the FTSE 250 was down again drifting towards an 11% loss, eradicating any intervening recovery,

The FTSE 350 lost £140bn in a day, recovered, lost it all again by 4.30pm Monday but has now recovered 5% from its 7% loss.

Banking Sector

Banks (domestic and foreign) in Britain have been told by EU members France and Netherlands that they will not be able to use the European financial ‘single passport’ access to unhindered trading resulting in additional banking costs and a reduced incentive for US and Asian banks to be based in the UK – Dublin, Frankfurt and Paris, are suddenly more attractive and expected to gain financial jobs from the City of London. Barclays and Royal Bank of Scotland (RBS) have lost 35% in value since Thursday and had their shares temporarily suspended on Monday. On Tuesday there was around a 5% recovery.

Whilst many 99%-ers on the Left might celebrate another banking collapse, those businesses that employ millions depend upon a stable lending banking system to finance their growth and pay wages.

Inflation Risk

The costs of imported raw materials, food, wine, petrol etc could rise 10% because of the Pound’s fall alone. If British businesses selling at home want to keep prices the same, they will have to cut back office costs and jobs instead. Yes, we will recover, but book a “one-way ticket”, to quote George Osborne, for more austerity, unemployment and inflation pain first.

Housing Market

House prices may fall in the short term according to Savills but so will affordability, mortgages, and lending criteria stress tests may rise. International buyers may take advantage of a cheaper Pound to buy here, whilst locals are priced out of the mid-market. House builders have seen significant share price falls and the FTSE triggered its ‘circuit-breaker’ to suspend trading in all house builders temporarily. For instance, Taylor Wimpey fell 16% (40% since Thursday), Persimmon 17.4% (38% in 2 days) and Barratt Developments fell almost 20.7% (38.4% in 2 days), Bovis Homes 33% in 2 day etc. In addition, with the credit rating trashing they will find it harder to fund new building developments, further intensifying our domestic housing crisis.

Radio 4’s You and Yours is reporting people seeing immediate 5% drops in house sale prices due to Brexit – ‘Brexundering’.

We could eventually see a quadruple-whammy of wage restraint, credit crunch, inflation and interest rate rises, affecting house buyers and stifling the pressured renting sector too.

Pensions

It has been reported that particularly those living abroad may lose UK annual increases with inflation to their pensions, but also those at home might lose the “triple lock” guarantee. Pension funds held privately on the stock market will obviously go up and down with the fortunes of the FTSE, currently down. Of course, Leave leader, Boris Johnson said pensions would be unaffected, he also said the NHS would get £350m a week and that among many pseudo-promises has already been pulled.

Credit Rating and Economic Outlook

After the Brexit vote, Moody’s changed the UK credit outlook to “negative” from stable. Fitch see it likewise and downgraded it to AA negative. Today, Standard & Poor (S&P) have followed suit and downgraded our last remaining Triple-A national credit rating two-notches from AAA to AA:

“In the nationwide referendum on the U.K.’s membership of the European Union (EU), the majority of the electorate voted to leave the EU. In our opinion, this outcome is a seminal event, and will lead to a less predictable, stable, and effective policy framework in the U.K. … The vote for “remain” in Scotland and Northern Ireland also creates wider constitutional issues for the country as a whole. Consequently, we are lowering our long-term sovereign credit ratings on the U.K. by two notches to ‘AA’ from ‘AAA’.” – S&P

“Fitch has revised down its forecast for real GDP growth to 1.6% in 2016 (from 1.9%), 0.9% in 2017 and 0.9% in 2018 (both from 2.0% respectively), leaving the level of real GDP a cumulative 2.3% lower in 2018 than in its prior ‘Remain’ base case.” – Fitch

“S&P maintained its negative outlook on the UK, which means there is a one-in-three chance of another downgrade in the next two years. The UK is now deemed less credit worthy than the US and EU by S&P, and the decsion marks its exit from an elite club of countries such as Switzerland and Australia that stil have a AAA rating.” – Daily Telegraph

A survey of 1,000 directors at the weekend reveals that roughly 20% are expecting to issue redundancies, over 20% are freezing recruitment, and 20% considering moving some operations to Europe.

Worst Economic Crisis since WWII

A former Organisation for Economic Cooperation and Development (OECD) economist has warned that the UK faces its worst economic crisis since the Second World War. It is certainly on track to challenge 2008’s banking crisis and 1987’s Black Monday crashes which saw £63bn wiped out. Other crises include the 1974 General Election which saw one-day losses of 7.1%. Back in 1929 the Dow Jones witnessed a 22.5% drop in a single day.

Always Look on the Bright Side …

Yes, we will weather it, and in the long term it may make little difference, but the short-medium term is going to be harder. We still have to pay into the EU budget, but will begin to be shut out of meetings and decisions, we will still have freedom of movement and migration for EU citizens for at least 2 years, if not beyond if we follow the likely Norway or Swiss models. It is highly unlikely the EU will allow us the Canadian model, indeed Angela Merkel said today that the UK would have to accept freedom of movement. The EU do not want to encourage other exits. Many are trying to find legal ways to vote out of the Referendum result.